Let’s get into my approach on how i set up a covered call on a dividend paying stock. My favorite equities for selling covered calls on are the spy (spdr s&p500 etf), and large, quality companies such as apple and google.

Robinhood is a great app thats lets you invest in stocks.

Top stocks to sell covered calls. Sell covered calls against stocks that are slow moving or stable in price unless you want to get rid of them because they are volatile, then you want them in an up trend. It is called “covered” because should the option be exercised you own the stock required to fulfill the delivery obligation for the 100 shares, as opposed to selling a naked call, where you don’t own the underlying stock, which represents an unlimited liability for the seller. Boeing stock boeing co (nyse:ba) is a strong candidate to.

Selling covered calls is a guaranteed way to earn weekly monthly income, and yes, it can be very profitable. The higher the dividend payout, the more of a drag that dividend will be on the premium income you'll receive selling calls. The underlying stock, the term, and the strike.

Every covered call trade involves three decisions: Selling covered calls often allows you to lock in a much higher yield than the current dividend yield of most. If you want a passive strategy, you can buy an etf and sell covered calls, or keep reading to learn a better way to invest.

See 3 stocks you can double your quarterly dividend on right now. Best stocks to cover calls every week. 02, 2010 2:29 pm et cat, ge.

The premiums aren’t gigantic, but if the stock isn’t called away, then that premium you just sold could be thought of as a dividend. I've been making bank selling covered calls 20% higher 65 rows a covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying instrument, such as shares of a stock or other securities.

I spent some time on google for decent stocks under $10, but after reviewing them, it looks like a lot of the ones recommended already had a run somewhat. Is selling covered calls profitable? In this video i will talk about what i look for when selling covered calls, from dividends to what.

Depending on your investment goals, there are. Covered calls are a proven way to bring in extra retirement income and mitigate equity risks. To sell covered calls, you have to own stock.

Best online brokers for covered calls. Volatility is high and they're all good companies. Downside of selling covered calls.

When writing covered calls you are protected against unlimited losses in the event that the strike price dips below the market price of. Your best bet for finding the best stocks for covered calls is to limit your selection to those stocks that pay zero or small dividends, or else make sure you time the dividend cycle so that you have no short call positions at distribution. Berkshire stock may be the perfect stock for covered calls.

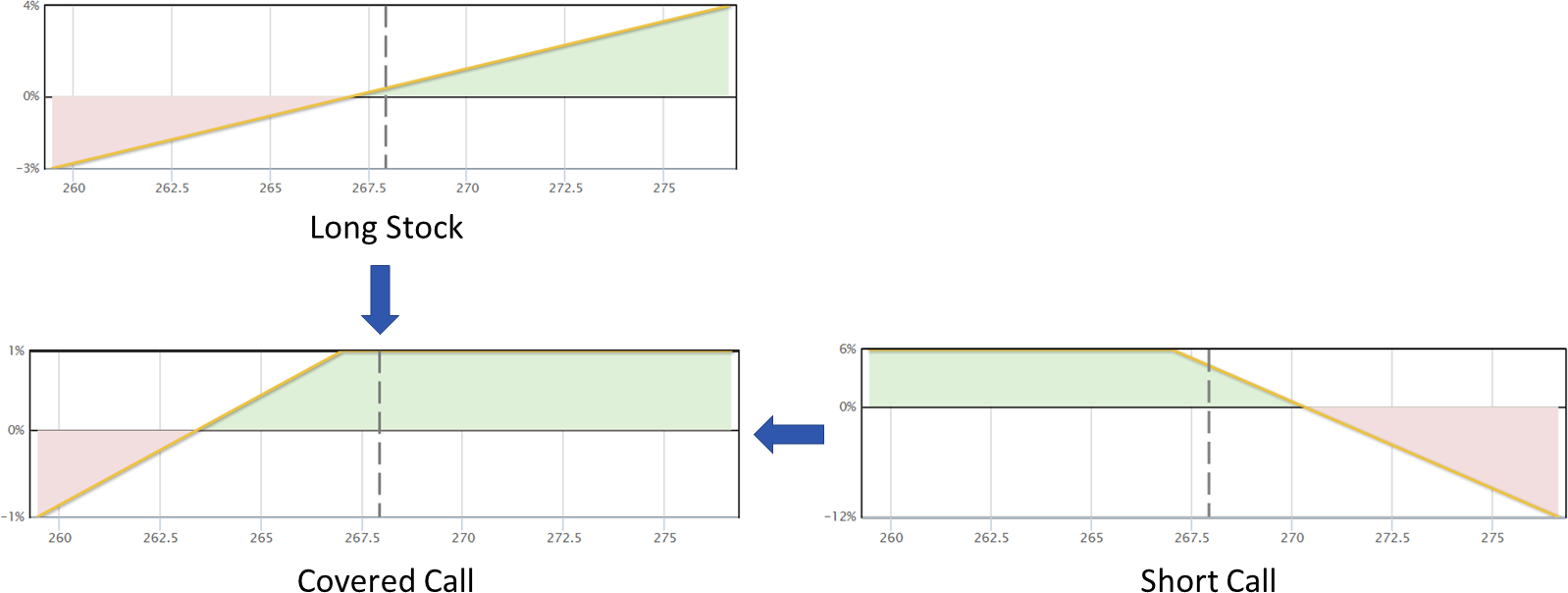

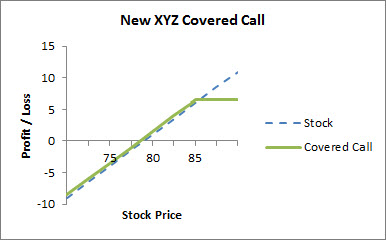

Best stocks i've seen are pltr, open, afrm, and mile. These are two dividend stock examples that are some of the best stocks to write covered calls against. Long stock + short call = covered call.

The best stock candidates for writing covered calls on are usually big, stable, blue chip companies listed on the major stock exchanges. If you want to write covered calls, you must follow your criteria and stick to your plan. The problem is that everyone knows they are stable so the premium is not very high so just like everything el.

Of income covered the reward call can be 23 times divided by stock, and so you can to go ahead with dividends and some capital appreciation. If you already own a stock (or an etf), you can sell covered calls on it to boost your income and total returns. If you already have an account a you can sell stocks (or etfs) covered calls upon it to increase revenue and overall revenue.

They don't pay the highest premiums but they are usually less volatile, which conservative investors like. I have been looking for a good entry level stock to sell my first covered call. Two of the best stocks for covered call writing in today’s market.

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

0 komentar:

Posting Komentar